The Three-Party Dance: Why Traditional Negotiation Fails

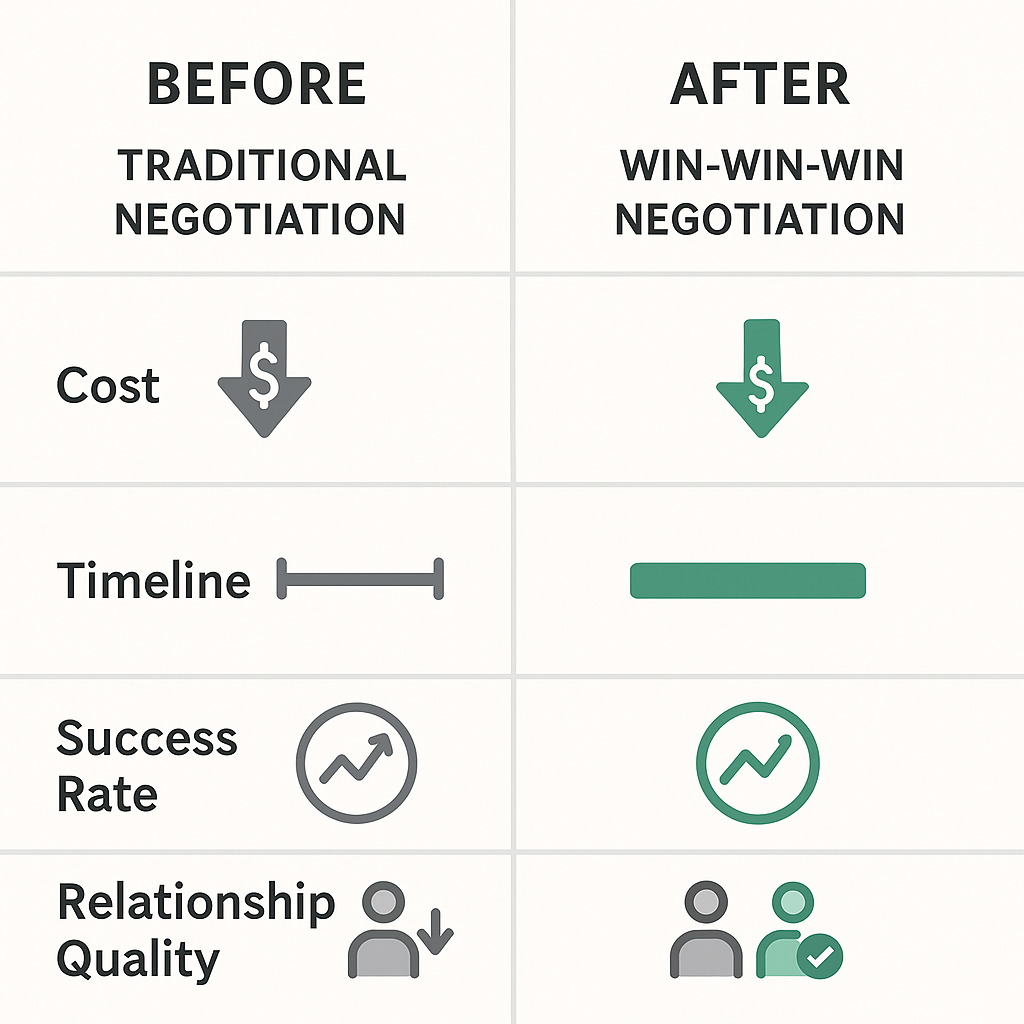

Most SaaS procurement advice treats negotiation as a zero-sum game between buyer and vendor. This fundamentally misunderstands the modern PIM/DAM landscape, where three distinct parties have overlapping but different interests:

- The SaaS Vendor: Balancing growth, profitability, and valuation goals

- The Buying Organization: Solving business problems while managing risk and cost

- The Implementation Partner: Delivering successful projects while building long-term relationships

Drawing from negotiation psychology in works like 'Getting to Yes' and 'Never Split the Difference,' successful SaaS deals require understanding each party's underlying interests, not just their stated positions.

This guide provides a framework for creating sustainable win-win-win scenarios that lead to successful implementations, satisfied customers, and profitable vendor relationships.

Key Insight: The best SaaS deals aren't the cheapest—they're the ones where all three parties achieve their core objectives, creating a foundation for long-term success.

Stakeholder Analysis: Understanding the Real Motivations

The SaaS Vendor: Beyond Revenue Recognition

Understanding vendor economics is crucial for effective negotiation. SaaS companies operate under fundamentally different financial pressures than traditional software vendors:

Financial Structure & Motivations

- CapEx Considerations: R&D investments in product development, requiring predictable revenue streams to justify continued innovation

- OpEx Reality: Hosting costs, compute resources, and support infrastructure that scale with customer usage

- Growth Stage Impact: Pre-revenue companies prioritize user acquisition and product-market fit over profitability

- Valuation vs. Cash Flow: Growth-stage companies often sacrifice short-term profit for higher valuations, while mature companies focus on sustainable cash flow

Strategic Vendor Interests

- Reference-able customers: Especially in their target industry vertical

- Sales cycle participation: Joint selling opportunities and case study development

- Product feedback: Feature requests and roadmap input from sophisticated users

- Market validation: Social proof for their solution category and positioning

- Total Contract Value (TCV): Multi-year commitments that improve their recurring revenue metrics

- Logo credibility: Brand names that enhance their credibility in sales processes

🔍 Tip: Research the vendor's recent funding rounds, public statements about growth targets, and hiring patterns to understand their current priorities.

The Buying Organization: Beyond Cost Optimization

Primary Business Objectives

Successful negotiations recognize that buyers are solving business problems, not just procuring software:

Operational Success Factors

- Problem Resolution: Addressing specific PIM/DAM pain points that triggered the search

- User Adoption: Ensuring marketing teams, product managers, and content creators actually use the system

- Migration Security: Safe transfer of existing product data and digital assets without loss

- Integration Success: Seamless connectivity with existing martech, e-commerce, and ERP systems

- Scalability Assurance: Platform growth capacity matching business expansion plans

Risk Management Priorities

- Vendor Lock-in Avoidance: Maintaining data portability and exit strategies

- Security Compliance: Meeting industry-specific security and compliance requirements

- IT Operational Control: Maintaining security, backup, and access management standards

- Shadow IT Prevention: Avoiding unauthorized tool proliferation that creates data silos

Organizational Dynamics

Understanding internal politics often matters more than technical requirements:

- Marketing Autonomy: Marketing teams may prefer tools they can control vs. IT-managed solutions

- Budget Ownership: Whether PIM/DAM falls under IT, Marketing, or Operations budgets affects decision criteria

- Change Management: Organizational readiness for new processes and tool adoption

- Success Metrics: How the organization will measure ROI and project success

Buyer Psychology Insight: Fear of making the wrong choice often outweighs desire for the best deal. Reducing perceived risk is frequently more valuable than reducing price.

The Implementation Partner: Building Sustainable Relationships

Strategic Implementation Partner Interests

As an implementation partner, your role extends far beyond project delivery. You're building an ecosystem of relationships that enable future opportunities:

Project-Level Objectives

- Delivery Excellence: Successful implementations that serve as reference cases

- Scope Management: Well-defined projects that can be delivered profitably

- Timeline Predictability: Advance booking that enables resource planning and utilization

- Technical Risk Mitigation: Platforms and vendors that support reliable delivery

Vendor Relationship Building

- Preferred Partner Status: Recognition and benefits from vendor partner programs

- Sales Collaboration: Joint selling opportunities and deal registration benefits

- Technical Enablement: Early access to new features, training, and support

- Market Positioning: Vendor endorsement that enhances credibility with prospects

Client Portfolio Development

- Solution Extensibility: PIM/DAM foundations that enable future projects (Amazon marketplace, B2B portals, omnichannel commerce)

- Long-term Relationships: Moving beyond project delivery to strategic advisory roles

- Reference Development: Case studies and success stories that attract similar clients

- Cross-selling Opportunities: Adjacent technology needs that arise from successful PIM/DAM implementations

The Implementation Partner's Unique Value

Your position as implementation partner provides unique leverage in negotiations:

- Market Intelligence: Cross-vendor insights about pricing, capabilities, and roadmaps

- Risk Assessment: Real-world experience with implementation challenges and success factors

- Relationship Capital: Ongoing relationships with both buyers and vendors

- Future Pipeline: Ability to influence vendor selection for future opportunities

The Win-Win-Win Negotiation Framework

Phase 1: Preparation - Understanding True Interests

Effective negotiation begins long before price discussions. Following the principles of interest-based negotiation:

Vendor Research Deep Dive

- Financial Position: Recent funding, revenue growth, profitability status

- Market Position: Competitive landscape, differentiation strategy, target segments

- Product Roadmap: Development priorities, technology investments, strategic direction

- Partner Ecosystem: Integration partnerships, reseller relationships, implementation networks

- Customer Success Metrics: How they measure and report customer success

Internal Stakeholder Alignment

- Decision Criteria Mapping: Understanding weighted priorities across stakeholders

- Budget Reality Check: Total cost of ownership beyond license fees

- Success Definition: Specific, measurable outcomes that define project success

- Risk Tolerance Assessment: Organization's appetite for vendor risk, implementation complexity

- Timeline Constraints: Business drivers that create urgency or flexibility

Phase 2: Value Creation Before Price Discussion

The most successful negotiations expand the pie before dividing it:

Joint Value Identification

- Reference Case Potential: How compelling would this implementation be as a vendor case study?

- Market Development: Does this client open new market segments or use cases for the vendor?

- Product Development Input: What unique requirements could enhance the vendor's roadmap?

- Ecosystem Expansion: How might this implementation drive additional vendor partnerships?

Implementation Success Factors

- Change Management Support: Vendor resources for user adoption and training

- Technical Architecture: Integration capabilities that reduce implementation risk

- Data Migration Tools: Vendor-provided utilities that accelerate go-live

- Ongoing Support: Success management resources beyond standard support

SaaS Pricing Psychology: The Economics Behind the Numbers

Understanding SaaS Vendor Economics

SaaS pricing isn't arbitrary—it's driven by specific financial models that create negotiation opportunities:

Key Financial Metrics That Drive Vendor Behavior

- Customer Acquisition Cost (CAC): Total cost to acquire a customer, including sales, marketing, and onboarding

- Monthly Recurring Revenue (MRR): Predictable monthly revenue that forms the foundation of SaaS valuations

- Customer Lifetime Value (CLV): Total revenue expected over the customer relationship

- CAC Payback Period: Time required to recover customer acquisition costs

- Annual Recurring Revenue (ARR): Annualized version of MRR used for planning and valuation

- Net Revenue Retention: Expansion revenue from existing customers

How Vendor Stage Affects Negotiation Leverage

Early-Stage Vendors (Pre-Series A):

- Prioritize user acquisition and product-market fit over immediate profitability

- Highly motivated by reference customers and case studies

- Often flexible on pricing in exchange for implementation partnership and feedback

- May offer equity or revenue-sharing arrangements for key accounts

Growth-Stage Vendors (Series A-C):

- Balancing growth metrics with path to profitability

- Focus on increasing Average Contract Value (ACV) and reducing churn

- Interested in multi-year deals that improve revenue predictability

- Value strategic partnerships that accelerate market penetration

Mature Vendors (Series D+ or Public):

- Emphasis on profitability and operational efficiency

- Less flexibility on pricing but more investment in customer success

- Focus on expansion revenue and platform ecosystem development

- Strong emphasis on reducing customer acquisition costs through partners

Pricing Structure Psychology

Why Vendors Prefer Annual Contracts

- Cash Flow Management: Upfront annual payments improve cash position

- Revenue Recognition: Predictable revenue streams support higher valuations

- Churn Reduction: Annual commitments reduce monthly churn rates

- Sales Efficiency: Larger deals improve sales team productivity metrics

The True Cost of Customer Churn

Understanding why vendors fear churn helps identify negotiation leverage:

- Lost Future Revenue: Customers typically expand usage over time

- Reference Impact: Public departures affect credibility with prospects

- Support Cost Recovery: Implementation costs are amortized over customer lifetime

- Ecosystem Effects: Customer departures can affect partner relationships

Advanced Negotiation Tactics: Beyond Price Reduction

Recommended Reading: Hostage at the Table

George Kohlrieser's framework for resolving conflicts applies directly to SaaS negotiations. The 'mourning process' concept is particularly relevant—embracing new technology often requires letting go of existing systems and processes, creating natural resistance that negotiators must address.

The Implementation Partner's Strategic Advantage

As an implementation partner, you possess unique leverage that individual buyers lack:

Portfolio Leverage

- Future Deal Pipeline: Ability to influence vendor selection for upcoming projects

- Cross-Client Intelligence: Market knowledge about competitive pricing and terms

- Relationship Capital: Ongoing vendor relationships that extend beyond individual deals

- Success Track Record: Proven ability to deliver successful implementations

Value-Based Negotiation Strategies

Strategy 1: The Reference Case Premium

- Position the client as an ideal reference case for the vendor's target market

- Negotiate case study participation in exchange for pricing concessions

- Offer speaking opportunities at vendor events or conferences

- Provide detailed success metrics for vendor sales enablement

Strategy 2: The Innovation Partnership

- Identify unique client requirements that could enhance the vendor's roadmap

- Propose early access to beta features in exchange for development feedback

- Offer to participate in vendor advisory boards or customer councils

- Negotiate custom development costs as product investment rather than client expense

Strategy 3: The Ecosystem Expansion

- Highlight integration requirements that could drive vendor partnerships

- Propose joint go-to-market opportunities in your client's industry

- Offer to facilitate introductions to complementary technology vendors

- Negotiate ecosystem development costs as shared investment

Tactical Negotiation Techniques

The Anchoring Effect in SaaS Pricing

- High Anchor Strategy: Begin with comprehensive requirements that justify premium pricing, then scale back

- Alternative Framing: Compare total cost of ownership rather than license fees alone

- Value Anchoring: Establish the cost of not solving the problem before discussing solution costs

- Competitive Anchoring: Use market intelligence to establish pricing expectations

Time-Based Leverage

- Quarter-End Timing: SaaS companies often offer better terms to meet quarterly targets

- Budget Cycle Alignment: Align contract terms with client budget cycles for renewal predictability

- Implementation Urgency: Balance urgency with vendor capacity constraints

- Renewal Timing: Stagger multiple vendor renewals to avoid negotiation fatigue

Creative Deal Structures: Beyond Standard Pricing

| Structure Type | Vendor Benefit | Client Benefit | Implementation Partner Benefit | Risk Factors |

|---|---|---|---|---|

| Traditional Fixed Pricing | Predictable revenue, simple sales process | Known upfront costs, budget certainty | Standard project margins | Misaligned incentives, no flexibility |

| Usage-Based Scaling | Revenue grows with client success | Pay only for value delivered | Ongoing optimization retainers | Revenue unpredictability |

| Performance-Based | Guaranteed client success metrics | ROI-linked investment protection | Success-based fee premiums | Complex measurement systems |

| Partnership Revenue Share | Long-term client relationship | Vendor invested in business growth | Ongoing partnership income | Complex partnership agreements |

| Phased Implementation | Reduced delivery risk | Pay for proven milestones | Predictable cash flow | Extended timeline complexity |

| Reference Case Premium | Marketing value, case studies | Reduced pricing for visibility | Joint marketing opportunities | Public scrutiny of results |

Alternative Pricing Models

Standard SaaS pricing often fails to align vendor and client interests. Creative structures can benefit all parties:

Performance-Based Pricing

- Usage-Based Scaling: Pricing that grows with client business success (revenue, transaction volume, user adoption)

- ROI-Linked Pricing: Vendor fees tied to measurable business outcomes

- Success Milestones: Graduated pricing based on implementation milestones and user adoption

- Renewal Incentives: Progressive discounts for multi-year renewals based on success metrics

Partnership-Based Structures

- Revenue Sharing: Vendor participation in client business growth enabled by the platform

- Equity Arrangements: For early-stage vendors, equity participation in high-growth clients

- Co-Investment Models: Shared investment in custom development or market expansion

- Joint Venture Opportunities: Collaborative development of new market solutions

Risk Mitigation Structures

- Phased Implementation Pricing: Staged payments tied to delivery milestones

- Success Guarantees: Vendor penalties for failed implementations or adoption targets

- Exit Clauses: Structured termination rights with data portability guarantees

- Performance SLAs: Service level agreements with financial penalties for non-compliance

Implementation Partner Fee Structures

Beyond Project-Based Billing

- Success-Based Fees: Implementation partner compensation tied to client success metrics

- Ongoing Partnership: Retainer-based relationships for continued optimization and expansion

- Vendor Partnership Revenue: Recurring income from vendor partner programs and deal registration

- Platform Revenue Sharing: Participation in client business growth enabled by successful implementations

Value Creation Through Deal Structure

Example: The Multi-Year Success Partnership

- Year 1: Reduced pricing in exchange for implementation partnership and case study development

- Year 2-3: Standard pricing with expansion options based on user adoption and business growth

- Year 4+: Partnership pricing based on demonstrated success and reference value

- Implementation partner receives ongoing success management retainer and vendor partnership benefits

The Complete Negotiation Playbook

Pre-Negotiation Checklist

Intelligence Gathering

- □ Vendor financial position and growth stage research

- □ Competitive landscape analysis and pricing benchmarks

- □ Client stakeholder mapping and decision criteria

- □ Implementation partner relationship assessment with vendor

- □ Market timing factors (quarter-end, budget cycles, vendor events)

Value Proposition Development

- □ Reference case potential assessment

- □ Market expansion opportunities for vendor

- □ Product development input opportunities

- □ Ecosystem partnership potential

- □ Implementation success factors and risk mitigation

Negotiation Sequence Strategy

Phase 1: Relationship Building (Weeks 1-2)

- Vendor Relationship: Establish implementation partner credibility and track record

- Client Relationship: Understand true business drivers and success criteria

- Expectation Setting: Align all parties on process, timeline, and decision criteria

- Value Identification: Discover mutual interests and potential win-win opportunities

Phase 2: Value Creation (Weeks 3-4)

- Requirements Refinement: Balance client needs with vendor capabilities

- Partnership Opportunities: Identify reference case, development input, and ecosystem potential

- Implementation Planning: Develop detailed success plan that reduces vendor risk

- Success Metrics: Define measurable outcomes that benefit all parties

Phase 3: Structure Negotiation (Weeks 5-6)

- Pricing Framework: Establish value-based pricing approach before discussing numbers

- Deal Structure: Negotiate terms that align interests (multi-year, performance-based, partnership)

- Risk Mitigation: Address client concerns about vendor lock-in, data portability, SLAs

- Implementation Terms: Define roles, responsibilities, and success criteria

Phase 4: Final Terms (Week 7)

- Price Optimization: Negotiate final pricing based on established value framework

- Contract Terms: Finalize legal terms that protect all parties' interests

- Success Planning: Establish post-signature implementation and success management plan

- Relationship Continuity: Define ongoing partnership and expansion opportunities

Common Negotiation Pitfalls and How to Avoid Them

Buyer-Side Pitfalls

The Feature Checklist Trap

- Problem: Focusing on feature comparison rather than business outcome alignment

- Solution: Prioritize platforms that solve core business problems with room for growth

- Red Flag: When vendor demos focus on feature breadth rather than client-specific use cases

The Lowest Price Fallacy

- Problem: Optimizing for initial cost rather than total cost of ownership or business value

- Solution: Include implementation, training, integration, and ongoing management costs

- Red Flag: Vendors who compete primarily on price often lack investment in product development

The Single Vendor Dependency

- Problem: Negotiating with only one vendor, eliminating competitive pressure

- Solution: Maintain multiple viable options throughout the negotiation process

- Red Flag: When internal stakeholders become emotionally attached to a specific vendor

Vendor-Side Pitfalls

The Discounting Death Spiral

- Problem: Competing on price rather than value, eroding margins and market perception

- Solution: Focus on unique value proposition and ideal customer profile

- Red Flag: When vendors immediately offer discounts without understanding client needs

The Implementation Partner Neglect

- Problem: Treating implementation partners as order-takers rather than strategic allies

- Solution: Invest in partner relationships and joint success planning

- Red Flag: Vendors who bypass implementation partners in client relationships

Implementation Partner Pitfalls

The Commission Optimization Trap

- Problem: Recommending vendors based on partner program benefits rather than client needs

- Solution: Maintain vendor-agnostic assessment focused on client success

- Red Flag: When partner program benefits influence technology recommendations

The Project Scope Creep

- Problem: Accepting undefined scope to win deals, leading to budget overruns and relationship damage

- Solution: Define clear deliverables, timelines, and change management processes upfront

- Red Flag: When clients expect implementation costs to be absorbed in vendor pricing

The Vendor Relationship Imbalance

- Problem: Over-relying on single vendor relationships or playing vendors against each other

- Solution: Build balanced portfolio of vendor relationships based on client needs

- Red Flag: When vendor relationships compromise objective client advisory

Real-World Case Studies: Win-Win-Win in Action

Case Study 1: The Reference Case Partnership

Situation: Mid-market fashion retailer implementing PIM for omnichannel expansion

Traditional Approach Would Have Been:

- Focus on getting lowest price through competitive bidding

- Standard 3-year contract with annual price increases

- Basic implementation support with handoff to customer success

- Vendor treats as standard deal in their pipeline

Win-Win-Win Approach:

- Client Value: 30% pricing discount in exchange for reference case participation and advisory board membership

- Vendor Value: Compelling case study in growing fashion vertical, speaking opportunities at trade shows, product feedback for mobile commerce features

- Implementation Partner Value: Joint marketing opportunities, priority vendor support, early access to new features for future clients

Results:

- Successful implementation completed 20% ahead of schedule

- Client achieved 150% ROI within 18 months

- Vendor gained 4 additional clients in fashion vertical

- Implementation partner secured preferred partner status and 3 additional projects

Case Study 2: The Innovation Partnership

Situation: Manufacturing company with complex B2B portal requirements

Challenge: Client needed custom API development that exceeded vendor's standard offerings

Win-Win-Win Solution:

- Client Value: Custom development costs treated as product investment rather than client expense

- Vendor Value: API enhancements became core product features, expanding their manufacturing market capability

- Implementation Partner Value: Deep technical expertise in new API capabilities, positioning for similar complex implementations

Structure:

- 50% of custom development costs covered by vendor as product investment

- Client received 2-year pricing freeze in exchange for beta testing and feedback

- Implementation partner received revenue sharing on future deals using new API capabilities

Case Study 3: The Ecosystem Expansion

Situation: Global brand requiring DAM integration with multiple e-commerce platforms

Opportunity: Client's integration requirements aligned with vendor's partnership expansion goals

Win-Win-Win Elements:

- Client Value: Free integration development with priority e-commerce platforms

- Vendor Value: Partnership development costs shared with client, new integration partnerships established

- Implementation Partner Value: Exclusive early access to new integrations, joint go-to-market opportunities

Long-term Impact:

- Vendor established 3 new technology partnerships

- Client achieved 40% faster time-to-market for new product launches

- Implementation partner became go-to specialist for complex DAM implementations

Measuring Success: KPIs for All Three Parties

Client Success Metrics

Immediate Implementation Success

- Time to Value: Days from go-live to first business value realization

- User Adoption Rate: Percentage of intended users actively using the system within 90 days

- Data Migration Success: Percentage of data successfully migrated without loss or corruption

- Integration Stability: System uptime and integration reliability metrics

Long-term Business Impact

- Operational Efficiency: Reduction in time for product launches, content updates, asset management

- Revenue Impact: Increased sales, faster time-to-market, improved conversion rates

- Cost Reduction: Decreased manual work, reduced errors, improved resource utilization

- Strategic Enablement: New business capabilities, market expansion, channel development

Vendor Success Metrics

Financial Performance

- Customer Lifetime Value (CLV): Total revenue potential from the relationship

- Net Revenue Retention: Expansion revenue from account growth

- Customer Acquisition Cost (CAC) Recovery: Time to recover investment in customer acquisition

- Reference Value: New business generated from case studies and references

Strategic Value

- Market Validation: Product-market fit evidence in target verticals

- Product Development: Feature requests and feedback that enhance roadmap

- Partnership Development: New technology integrations and ecosystem expansion

- Brand Enhancement: Logo credibility and market positioning improvement

Implementation Partner Success Metrics

Project Delivery

- On-time Delivery: Percentage of milestones delivered on schedule

- Budget Performance: Actual costs vs. projected costs

- Client Satisfaction: Net Promoter Score and reference willingness

- Scope Management: Change requests and scope creep management

Relationship Development

- Vendor Partnership Growth: Increased deal registration, partner tier advancement

- Client Portfolio Expansion: Follow-on projects and referrals from successful implementations

- Market Positioning: Recognition as specialist in PIM/DAM implementations

- Revenue Diversification: Mix of project revenue, retainer income, and partnership benefits

Measuring Negotiation Success

The true measure of negotiation success isn't who 'won' the most concessions, but whether all parties achieved their core objectives:

- Sustainability Test: Would all parties happily enter a similar agreement again?

- Relationship Quality: Did the negotiation strengthen or damage working relationships?

- Value Realization: Are all parties achieving their stated objectives?

- Market Feedback: How do peers and industry observers view the arrangement?

Deepen your understanding of PIM/DAM with these

Building Sustainable Success Through Win-Win-Win Negotiations

The most successful SaaS negotiations aren't battles to be won—they're partnerships to be built. When all three parties achieve their core objectives, the foundation is set for long-term success that extends far beyond the initial contract.

Key Takeaways for Implementation Partners

- Relationship Capital: Your ongoing relationships with both vendors and clients are your most valuable assets

- Value Creation: Focus on expanding the pie before dividing it—find ways to create value for all parties

- Long-term Perspective: Today's negotiation affects tomorrow's opportunities across your entire ecosystem

- Market Intelligence: Use your cross-vendor knowledge responsibly to benefit clients while maintaining vendor relationships

Explore examples of transformations and disruptions that may shape the future of SaaS procurement

The Future of SaaS Procurement

As the SaaS market matures, successful procurement increasingly depends on:

- Partnership over Procurement: Strategic relationships that enable business growth rather than cost optimization alone

- Outcome-Based Contracts: Pricing models that align vendor and client interests around business results

- Ecosystem Thinking: Understanding how individual tools fit into broader technology and business ecosystems

- Value-Based Decision Making: Moving beyond feature checklists to business impact assessment

By applying these negotiation principles, implementation partners can create sustainable competitive advantages while delivering exceptional value to both clients and vendor partners. The goal isn't just successful projects—it's building an ecosystem of relationships that enable continued growth and innovation.

Remember: The best negotiations are the ones where everyone walks away feeling like they won. When you achieve that in SaaS procurement, you've built the foundation for long-term success across your entire business ecosystem.